does workers comp deduct taxes

Through this program workers are provided with benefits and medical care and employers have the assurance that they will not be sued by the employee in most cases. Workers compensation is insurance paid by companies to provide benefits to employees who become ill or injured on the job.

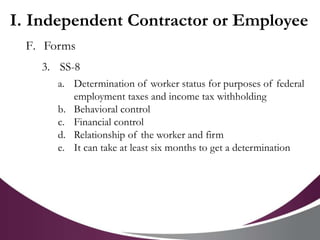

Compensation And Employment Tax Issues

While the income is offset with a deduction before the taxable income amount is calculated on your tax return the amount of the benefit is included for determining eligibility in such programs as CCB and GSTHST quarterly payments.

. No workers compensation payments are not taxed under Nevada state law. The federal government and individual states provide injured employees with workers compensation insurance benefits when they sustain job-related illnesses or injuries. Workers Compensation Insurance may be reported under Insurance Premiums in the Common Business Expenses section under Deductions.

Federal law the State of Nevada does not tax workers compensation payments. Perhaps you are wondering why only two-thirds of your average weekly wage is paid to you for workers comp. Any business would then consider a workers compensation insurance policy to be a normal business expense.

These are tax exempt benefits with only rare exceptions. Workers comp insurance meets both requirements to be considered tax deductible. You do not get a deduction for the workers compensation offset.

The question of whether or not workers comp benefits must be claimed on your taxes can be answered in one word. You can only claim a tax deduction for expenses. Note that if you reported wages compensation you should have entered workers compensation insurance in the Compensation section.

Workers compensation is typically one of those legally required employee benefits. Do you claim workers comp on taxes the answer is no. When filing taxes you do not need to add workers comp to your earned income.

The employee submits Forms CA-7 CA-7a and supporting medical documentation to WCC on 01012011. The employee must apply for Leave Buy Back within one year of the date OWCP approved the claim. No taxes are usually not taken out of your workers comp payments.

Workers comp benefits are obviously not an expense on your part. Employees receive a W-2 from their employer each year and the employer pays taxes and benefits on their behalf. You retire due to your occupational sickness.

Since workers compensation is considered necessary by law it is also a deductible expense on this front. An individual worker is either a W-2 employee or they are a 1099 Independent Contractor. Just like workers compensation benefits are not taxed under US.

If you are not receiving Social Security Disability benefits your workers comp will generally not be counted as taxable income. Is Workers Comp Tax Deductible. According to IRS Publication 525 page 19 does workers comp count as earned income for federal income taxes.

Does Workers Comp Count as Income. Since no taxes are taken from these benefits it is as if you are receiving after-tax dollars. Enter on your income tax return.

TurboTax Makes It Easy To Get Your Taxes Done Right. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Workers compensation benefits and settlements are fully tax-exempt which means you do not have to pay taxes.

What Exactly Is Workers Comp. An employees workers compensation claim is approved by OWCP on 12012009. Business Home Car Insurance Quotes The Hartford Insurance.

It qualifies as an ordinary expense and is considered. The leave buy back application is denied as untimely. No in most cases.

The simple answer is there is no such thing as a 1099 employee. Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if theyre paid under a workers compensation act or a statute in the nature of a workers compensation act. Thankfully workers compensation payments are fully tax-exempt under federal law and this is related to the determination of the amounts paid to you.

The IRS cross matches Box 5 on the SSA-1099 with your income tax return. No Tax Knowledge Needed. However retirement plan benefits are taxable if either of these apply.

As such the Internal Revenue Service doesnt allow employees to deduct workers compensation benefits from their taxes. But businesses may claim workers compensation premium as part of their tax. The amount in the PINK box shows the reportable amount paid by SSA.

According to the IRS Publication 907 Workers Compensation for an occupational sickness or injury if paid under a. Whether you have received weekly payments or a lump sum federal law does not allow it. Workers Compensation and Taxes Generally temporary benefits are considered to be earnings.

Get Your Max Refund Today. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness. Are Taxes Taken Out of Workers Compensation Payments.

In fact Nevada does not have an income tax. They arent taxed for a variety of reasons one being the fact that theyre not considered earned income under current tax laws. Workers compensation is essentially an insurance policy that employers in Tennessee and most of the country have to purchase by law.

Per IRS Publication 525 Taxable and Nontaxable Income page 19 Workers Compensation. Be sure you do not enter workmans compensation premiums in both locations.

Different Types Of Payroll Deductions Gusto

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Is My Workers Comp Taxable Ksa Insurance

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

Will My Workers Comp Benefits Be Taxed In California

Is Workers Comp Taxable Workers Comp Taxes

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen

Do I Have To Pay Taxes On A Workers Comp Payout Bachus Schanker

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

Every Landlord S Tax Deduction Guide Being A Landlord Tax Deductions Deduction Guide

Doing Business In The United States Federal Tax Issues Pwc

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Do I Have To Pay Taxes On A Workers Comp Payout Bachus Schanker

What Are Payroll Taxes And Who Pays Them Tax Foundation

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Workers Compensation And Taxes James Scott Farrin

Paying Taxes On Workers Compensation In Florida Johnson Gilbert P A